What is Enterprise Risk Management (ERM)?

Leaders of organizations must manage risks in order for the entity to stay in business. In fact, most would say that managing risks is just a normal part of running a business. So, if risk management is already occurring in these organizations, what’s the point of “enterprise risk management” (also known as “ERM”)?

Let’s Start by Looking at Traditional Risk Management

Business leaders manage risks as part of their day-to-day tasks as they have done for decades. Calls for entities to embrace enterprise risk management aren’t suggesting that organizations haven’t been managing risks. Instead, proponents of ERM are suggesting that there may be benefits from thinking differently about how the enterprise manages risks affecting the business.

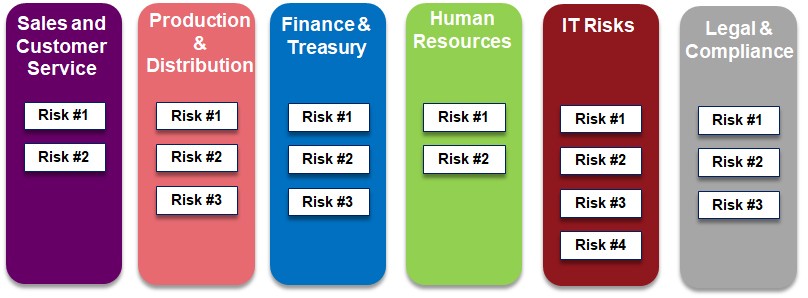

Traditionally, organizations manage risks by placing responsibilities on business unit leaders to manage risks within their areas of responsibility. For example, the Chief Technology Officer (CTO) is responsible for managing risks related to the organization’s information technology (IT) operations, the Treasurer is responsible for managing risks related to financing and cash flow, the Chief Operating Officer is responsible for managing production and distribution, and the Chief Marketing Officer is responsible for sales and customer relationships, and so on. Each of these functional leaders is charged with managing risks related to their key areas of responsibility. This traditional approach to risk management is often referred to as silo or stove-pipe risk management whereby each silo leader is responsible for managing risks within their silo as shown in Figure 1 below.

Figure 1 – Traditional Approach to Risk Management

Limitations with Traditional Approaches to Risk Management

While assigning functional subject matter experts responsibility for managing risks related to their business unit makes good sense, this traditional approach to risk management has limitations, which may mean there are significant risks on the horizon that may go undetected by management and that might affect the organization. Let’s explore a few of those limitations.

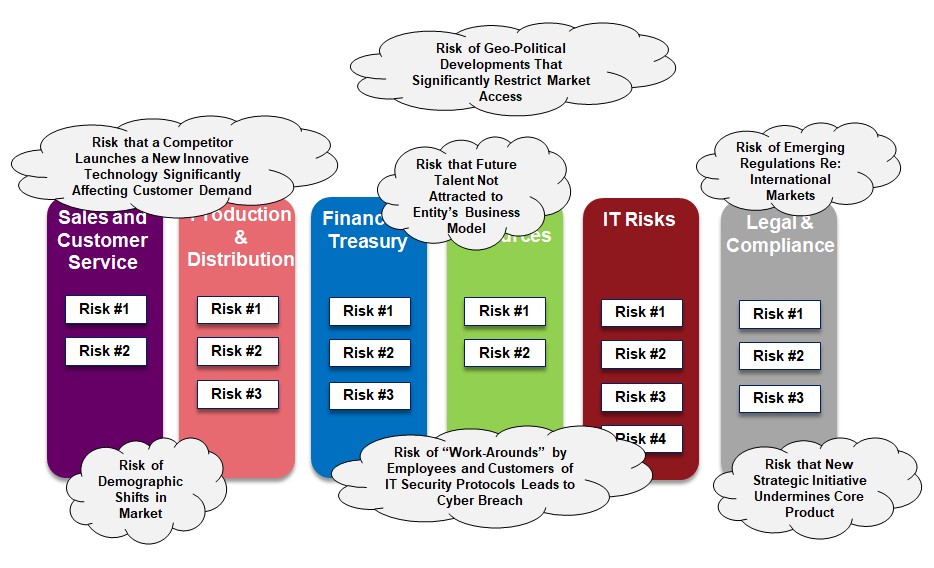

Limitation #1: There may be risks that “fall between the silos” that none of the silo leaders can see. Risks don’t follow management’s organizational chart and, as a result, they can emerge anywhere in the business. As a result, a risk may be on the horizon that does not capture the attention of any of the silo leaders causing that risk to go unnoticed until it triggers a catastrophic risk event. For example, none of the silo leaders may be paying attention to demographic shifts occurring in the marketplace whereby population shifts towards large urban areas are happening at a faster pace than anticipated. Unfortunately, this oversight may drastically impact the strategy of a retail organization that continues to look for real estate locations in outlying suburbs or more rural areas surrounding smaller cities.

Limitation #2: Some risks affect multiple silos in different ways. So, while a silo leader might recognize a potential risk, he or she may not realize the significance of that risk to other aspects of the business. A risk that seems relatively innocuous for one business unit, might actually have a significant cumulative effect on the organization if it were to occur and impact several business functions simultaneously. For example, the head of compliance may be aware of new proposed regulations that will apply to businesses operating in Brazil. Unfortunately, the head of compliance discounts these potential regulatory changes given the fact that the company currently only does business in North America and Europe. What the head of compliance doesn’t understand is that a key element of the strategic plan involves entering into joint venture partnerships with entities doing business in Brazil and Argentina, and the heads of strategic planning and operations are not aware of these proposed compliance regulations.

Limitation #3: Third, in a traditional approach to risk management, individual silo owners may not understand how an individual response to a particular risk might impact other aspects of a business. In that situation, a silo owner might rationally make a decision to respond in a particular manner to a certain risk affecting his or her silo, but in doing so that response may trigger a significant risk in another part of the business. For example, in response to growing concerns about cyber risks, the IT function may tighten IT security protocols but in doing so, employees and customers find the new protocols confusing and frustrating, which may lead to costly “work-arounds” or even the loss of business.

Limitation #4: So often the focus of traditional risk management has an internal lens to identifying and responding to risks. That is, management focuses on risks related to internal operations inside the walls of the organization with minimal focus on risks that might emerge externally from outside the business. For example, an entity may not be monitoring a competitor’s move to develop a new technology that has the potential to significantly disrupt how products are used by consumers.

Limitation #5: Despite the fact that most business leaders understand the fundamental connection of “risk and return”, business leaders sometimes struggle to connect their efforts in risk management to strategic planning. For example, the development and execution of the entity’s strategic plan may not give adequate consideration to risks because the leaders of traditional risk management functions within the organization have not been involved in the strategic planning process. New strategies may lead to new risks not considered by traditional silos of risk management.

What’s the impact of these limitations? There can be a wide array of risks on the horizon that management’s traditional approach to risk management fails to see, as illustrated by Figure 2. Unfortunately, some organizations fail to recognize these limitations in their approach to risk management before it is too late.

Figure 2 – Currently Unknown, But Knowable Risks Overlooked by Traditional Risk Management

Effective Enterprise Risk Management (ERM) Should be a Valued Strategic Tool

Over the last decade or so, a number of business leaders have recognized these potential risk management shortcomings and have begun to embrace the concept of enterprise risk management as a way to strengthen their organization’s risk oversight. They have realized that waiting until the risk event occurs is too late for effectively addressing significant risks and they have proactively embraced ERM as a business process to enhance how they manage risks to the enterprise.

The objective of enterprise risk management is to develop a holistic, portfolio view of the most significant risks to the achievement of the entity’s most important objectives. The “e” in ERM signals that ERM seeks to create a top-down, enterprise view of all the significant risks that might impact the strategic objectives of the business. In other words, ERM attempts to create a basket of all types of risks that might have an impact – both positively and negatively – on the viability of the business.

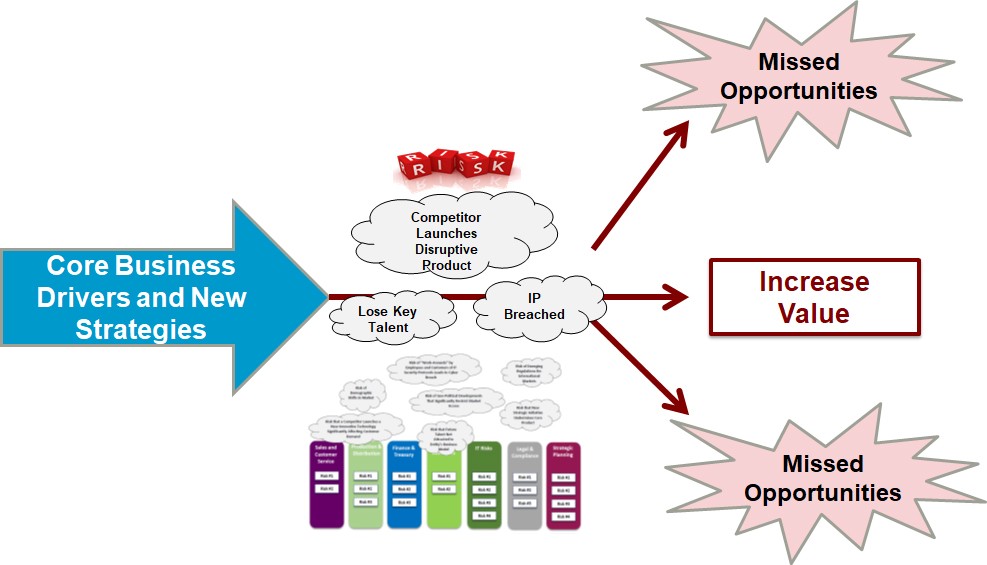

An effective ERM process should be an important strategic tool for leaders of the business. Insights about risks emerging from the ERM process should be an important input to the organization’s strategic plan. As management and the board become more knowledgeable about potential risks on the horizon they can use that intelligence to design strategies to nimbly navigate risks that might emerge and derail their strategic success. Proactively thinking about risks should provide competitive advantage by reducing the likelihood that risks may emerge that might derail important strategic initiatives for the business and that kind of proactive thinking about risks should also increase the odds that the entity is better prepared to minimize the impact of a risk event should it occur.

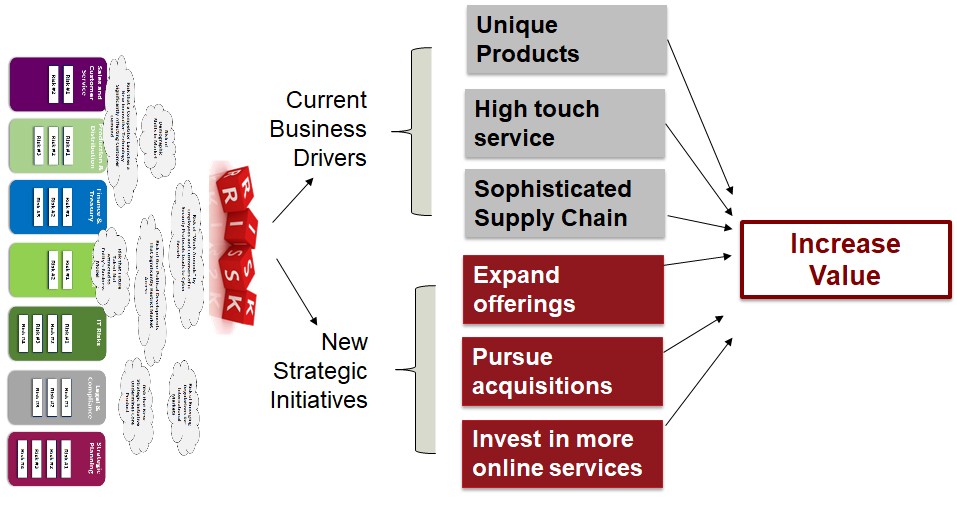

As illustrated by Figure 3, the ERM process should inform management about risks on the horizon that might impact the success of core business drivers and new strategic initiatives.

Figure 3 – ERM Should Inform Strategy of the Business

Elements of an ERM Process

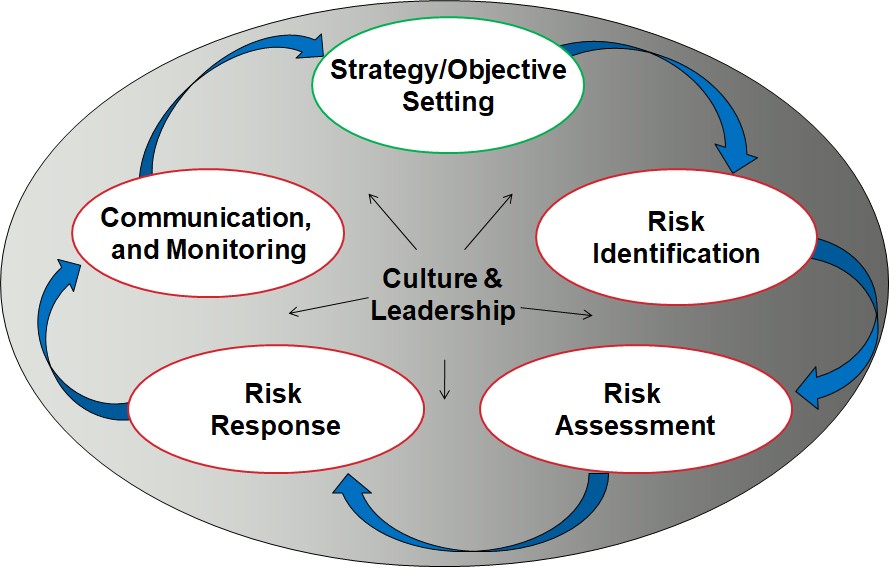

Because risks constantly emerge and evolve, it is important to understand that ERM is an ongoing process. Unfortunately, some view ERM as a project that has a beginning and an end. While the initial launch of an ERM process might require aspects of project management, the benefits of ERM are only realized when management thinks of ERM as a process that must be active and alive, with ongoing updates and improvements.

The diagram in Figure 4 illustrates the core elements of an ERM process. Before looking at the details, it is important to focus on the oval shape to the figure and the arrows that connect the individual components that comprise ERM. The circular, clockwise flow of the diagram reinforces the ongoing nature of ERM. Once management begins ERM, they are on a constant journey to regularly identify, assess, respond to, and monitor risks related to the organization’s core business model.

Figure 4 – Elements of an ERM Process

ERM Starts with What Drives Value for the Entity

Because ERM seeks to provide information about risks affecting the organization’s achievement of its core objectives, it is important to apply a strategic lens to the identification, assessment, and management of risks on the horizon. An effective starting point of an ERM process begins with gaining an understanding of what currently drives value for the business and what’s in the strategic plan that represents new value drivers for the business. To ensure that the ERM process is helping management keep an eye on internal or external events that might trigger risk opportunities or threats to the business, a strategically integrated ERM process begins with a rich understanding of what’s most important for the business’ short-term and long-term success.

Let’s consider a public-traded company. A primary objective for most publically traded companies is to grow shareholder value. In that context, ERM should begin by considering what currently drives shareholder value for the business (e.g., what are the entity’s key products, what gives the entity a competitive advantage, what are the unique operations that allow the entity to deliver products and services, etc.). These core value drivers might be thought of as the entity’s current “crown jewels”. In addition to thinking about the entity’s crown jewels, ERM also begins with an understanding of the organization’s plans for growing value through new strategic initiatives outlined in the strategic plan (e.g., launch of a new product, pursuit of the acquisition of a competitor, or expansion of online offerings etc.). You might find our thought paper, Integration of ERM with Strategy, helpful given it contains three case study illustrations of how organizations have successfully integrated their ERM efforts with their value creating initiatives.

With this rich understanding of the current and future drivers of value for the enterprise, management is now in a position to move through the ERM process by next having management focus on identifying risks that might impact the continued success of each of the key value drivers. How might risks emerge that impact a “crown jewel” or how might risks emerge that impede the successful launch of a new strategic initiative? Using this strategic lens as the foundation for identifying risks helps keep management’s ERM focus on risks that are most important to the short-term and long-term viability of the enterprise. This is illustrated by Figure 5.

Figure 5 – Apply Strategic Lens to Identify Risks

The Focus is on All Types of Risks

Sometimes the emphasis on identifying risks to the core value drives and new strategic initiatives causes some to erroneously conclude that ERM is only focused on “strategic risks” and not concerned with operational, compliance, or reporting risks. That’s not the case. Rather, when deploying a strategic lens as the point of focus to identify risks, the goal is to think about any kind of risk – strategic, operational, compliance, reporting, or whatever kind of risk – that might impact the strategic success of the enterprise. As a result, when ERM is focused on identifying, assessing, managing, and monitoring risks to the viability of the enterprise, the ERM process is positioned to be an important strategic tool where risk management and strategy leadership are integrated. It also helps remove management’s “silo-blinders” from the risk management process by encouraging management to individually and collectively think of any and all types of risks that might impact the entity’s strategic success.

Output of an ERM Process

The goal of an ERM process is to generate an understanding of the top risks that management collectively believes are the current most critical risks to the strategic success of the enterprise. Most organizations prioritize what management believes to be the top 10 (or so) risks to the enterprise (see our thought paper, Survey of Risk Assessment Practices, that highlights a number of different approaches organizations take to prioritize their most important risks on the horizon). Generally, the presentation of the top 10 risks to the board focuses on key risk themes, with more granular details monitored by management. For example, a key risk theme for a business might be the attraction and retention of key employees. That risk issue may be discussed by the board of directors at a high level, while management focuses on the unique challenges of attracting and retaining talent in specific areas of the organization (e.g., IT, sales, operations, etc.).

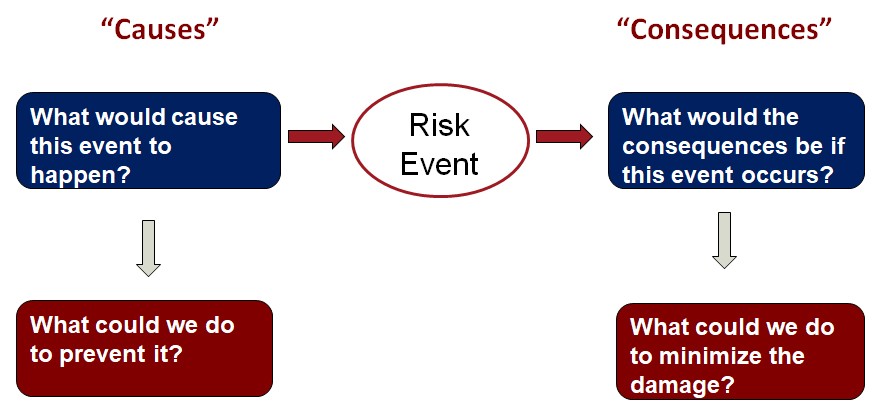

With knowledge of the most significant risks on the horizon for the entity, management then seeks to evaluate whether the current manner in which the entity is managing those risks is sufficient and effective. In some cases, management may determine that they and the board are willing to accept a risk while for other risks they seek to respond in ways to reduce or avoid the potential risk exposure. When thinking about responses to risks, it is important to think about both responses to prevent a risk from occurring and responses to minimize the impact should the risk event occur. An effective tool for helping frame thinking about responses to a risk is known as a “Bow-Tie Analysis”, which is illustrated by Figure 6. The left side of the “knot” (which is the risk event) helps management think about actions management might take to lower the probability of a risk occurring. The right side of the “knot” helps management think about actions that could be taken to lower the impact of a risk event should it not be prevented (take a look at our tool, ERM Tool: Using Bow-Tie Analysis to Develop Key Risk Indicators).

Figure 6 – Bow-Tie Tool for Developing Responses to Risks

Monitoring and Communicating Top Risks with Key Risk Indicators (KRIs)

While the core output of an ERM process is the prioritization of an entity’s most important risks and how the entity is managing those risks, an ERM process also emphasizes the importance of keeping a close eye on those risks through the use of key risk indicators (KRIs). Organizations are increasingly enhancing their management dashboard systems through the inclusion of key risk indicators (KRIs) linked to each of the entity’s top risks identified through an ERM process. These KRI metrics help management and the board keep an eye on risk trends over time. Check out our thought paper, Developing Key Risk Indicators to Strengthen Enterprise Risk Management, issued in partnership with COSO for techniques to develop effective KRIs.

Leadership of ERM

Given the goal of ERM is to create a top-down, enterprise view of risks to the entity, responsibility for setting the tone and leadership for ERM resides with executive management and the board of directors. They are the ones who have the enterprise view of the organization and they are viewed as being ultimately responsible for understanding, managing, and monitoring the most significant risks affecting the enterprise.

Top management is responsible for designing and implementing the enterprise risk management process for the organization. They are the ones to determine what process should be in place and how it should function, and they are the ones tasked with keeping the process active and alive. The board of director’s role is to provide risk oversight by (1) understanding and approving management’s ERM process and (2) overseeing the risks identified by the ERM process to ensure management’s risk-taking actions are within the stakeholders’ appetite for risk taking. (Check out our thought paper, Strengthening Enterprise Risk Management for Strategic Advantage, issued in partnership with COSO, that focuses on areas where the board of directors and management can work together to improve the board’s risk oversight responsibilities and ultimately enhance the entity’s strategic value).

Conclusion

Given the speed of change in the global business environment, the volume and complexity of risks affecting an enterprise are increasing at a rapid pace. At the same time, expectations for more effective risk oversight by boards of directors and senior executives are growing. Together these suggest that organizations may need to take a serious look at whether the risk management approach being used is capable of proactively versus reactively managing the risks affecting their overall strategic success. Enterprise risk management (ERM) is becoming a widely embraced business paradigm for accomplishing more effective risk oversight.

Interested in Learning More About ERM?

As business leaders realize the objectives of ERM and seek to enhance their risk management processes to achieve these objectives, they often are seeking additional information about tactical approaches for effectively doing so in a cost-effective manner. The ERM Initiative in the Poole College of Management at North Carolina State University may be a helpful resource through the articles, thought papers, and other resources archived on its website or through its ERM Roundtable and Executive Education offerings. Each year, we survey organizations about the current state of their ERM related practices. Check out our most recent research reports.

- Categories: