REPORT: Executive Perspectives on Top Risks for 2023 & 2032

The ERM Initiative in the Poole College of Management at North Carolina State University, in conjunction with global consulting firm Protiviti, annually surveys boards of directors and C-suite executives about risks on the horizon for the upcoming year. The most recent report, 2023 & 2032 Executive Perspectives on Top Risks, highlights top risks of immediate concern on the minds of executives for 2023 – and for the long-term – 2032.

Top Risks for 2023

The survey report – the eleventh annual such research report – assesses the concerns of 1,304 board members and executives globally, across a variety of industries. In addition to rising concerns about the economy, global supply chain disruptions, and crisis management capabilities, talent and culture risk issues dominate the top list of risks for 2023, suggesting those issues are a top concern on the minds of this year’s respondents as they navigate the war on talent.

Uncertainties in the global marketplace are at all-time highs, with respondents rating the overall severity and magnitude of risk conditions at the highest level we have seen in all eleven years we have conducted this survey. For 2023, all but three risks were ranked higher this year versus last year. For 2032, only a single risk was deemed to be a lower threat a decade from now, relative to concerns reported in last year’s report.

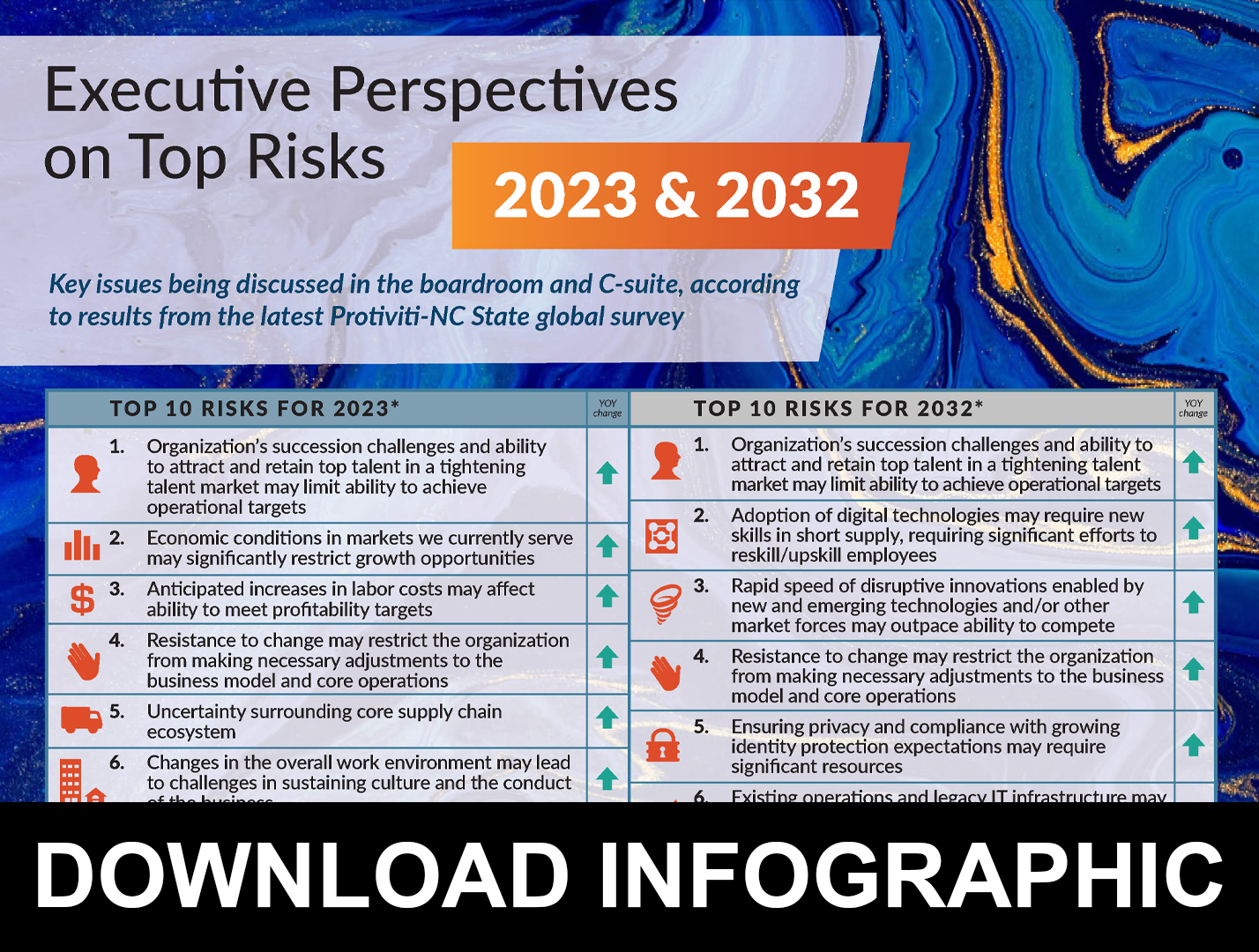

The Top 10 Risks for 2023

Survey respondents were asked to rate 38 macroeconomic, strategic and operational risks. The top risks identified for 2023 are:

- Organization’s succession challenges and ability to attract and retain top talent in a tightening talent market may limit ability to achieve operational targets

- Economic conditions in markets we currently serve may significantly restrict growth opportunities

- Anticipated increases in labor costs may affect ability to meet profitability targets

- Resistance to change may restrict the organization from making necessary adjustments to the business model and core operations

- Uncertainty surrounding core supply chain ecosystem may continue for the foreseeable future

- Changes in the overall work environment may lead to challenges in sustaining culture and the conduct of the business

- Adoption of digital technologies may require new skills in short supply, requiring significant efforts to reskill/upskill employees

- Organization’s culture may not sufficiently encourage the timely identification and escalation of risk issues

- Approaches to managing demands on or expectations of a significant portion of workforce to work in a hybrid or remote environment may negatively impact talent retention

- Organizations may not be sufficiently resilient and/or agile to manage an unexpected crisis

The Top 10 Risks for 2032

The Top Risks Through 2032

Survey respondents also rated the expected impact of the same 38 risks for 2032 to assess how the risk landscape might shift over the coming decade. According to survey respondents, concerns about their ability to compete in a technology-driven economy and concerns about unexpected disruptive innovations and related demands for talent skilled in data analytics and digital platforms for business are at the forefront, as the survey identified the following as the top 10 risks for 2032:

- Organization’s succession challenges and ability to attract and retain top talent in a tightening market may limit ability to achieve operational targets

- Adoption of digital technologies may require new skills in short supply, requiring significant efforts to reskill/upskill employees

- Rapid speed of disruptive innovations enabled by new and emerging technologies and/or other market forces may outpace ability to compete

- Resistance to change may restrict the organization from making necessary adjustments to the business model and core operations

- Ensuring privacy and compliance with growing identity protection expectations may require significant resources

- Existing operations and legacy IT infrastructure may not be able to meet performance expectations as well as “born digital” competitors

- Inability to utilize data analytics and “big data” may limit the achievement of market intelligence and increase productivity and efficiency

- Economic conditions in markets we currently serve may significantly restrict growth opportunities

- Regulatory changes and regulatory scrutiny may heighten, noticeably affecting how products or services will be produced or delivered

- Anticipated increases in labor costs may affect ability to meet profitability target

Key Risk Themes

There are several important risk themes prominent in this year’s report:

The risk landscape is changing. The churn in types of risks for 2023 relative to the prior year is noticeable, with five new risks not included in the top 10 risks last year appearing in the top 10 risk list for 2023.

Strikingly, two of the top 10 risks reflect concerns related to the organization’s culture. Concerns about an overall resistance to change and concerns about whether the organization’s culture helps facilitate the timely escalation of risks made the top 10 risks for 2023.

The economy is top of mind with concerns top of mind around the globe about multi-year inflationary challenges affecting the organization’s growth opportunities.

Talent and technology concerns dominate the composition of top risks with their interconnectivity important to recognize.

Attracting and retaining top talent and succession planning is the top risk concern issue for 2023, with executives and boards concerned about their organization’s ability to attract and retain talent capabilities in these areas.

Executives and boards recognize the need to embrace new technologies and digital innovations, but they struggle to find the talent that can help to fully realize the value proposition associated with new technologies and digital innovations.

Given stiff competition in the talent marketplace, respondents are concerned about anticipated increases in labor costs impacting achievement of profitability goals.

Evolving approaches to managing hybrid and remote work environments and the escalating demands about the nature of work among those in the workforce are at the forefront for executives and boards.

There are diverse risk perspectives across the C-suite and boardroom. Executives and boards are not on the same page regarding what constitutes the top risks on the horizon for 2023 and a decade out.

Macroeconomic risks dominate the risks increasing the most in 2023 compared to their ratings for 2022. Geopolitical concerns, likely heightened by conflicts in Eastern Europe and ongoing challenges and tensions emerging out of Asia, particularly developments in China, are top of mind for executives and boards.

Shifts in Short-Term vs Long-Term Risks

There are noticeable differences in the top risks lists for 2023 and 2032. Merely focusing on near-term risks may inadequately prepare executives and boards for risks emerging a decade out, given five of the top 10 risks in 2032 did not make the top 10 list for 2023. Waiting to recognize and plan for those longer-horizon risks may put an organization in catch up mode, if it’s not too late already. Amid the opportunities and challenges is the need to closely examine each organization’s readiness and resilience in the face of inevitable disruptive change and unexpected surprises. An ability to adjust and pivot could become the key differentiator between winners and losers.

Risks on the horizon for 2032 indicate an overarching intersection of disruptive innovation, advancing technologies, and talent challenges. Executives indicate concerns about emerging innovations and their organization’s ability to attract, afford, and retain the skills needed to embrace change, particularly changes to technology infrastructures to compete with those “born digital” and to leverage data analytics to garner insights needed to be competitive. These risks sustain the ongoing narrative that the 2020’s is indeed a decade of disruption.

Risk Differences Exist Across Respondents and Organizations

Like our prior studies, we conduct a number of analyses across different subsets of our sample, including analyses across sizes and types (i.e., publicly traded, private for-profit and not-profit/governmental) of organizations, industries and geography, and we are able to analyze the findings across different types of respondents (i.e., board members, CEOs, CFOs, etc.) There are a number of significant differences in top risks concerns across different types of organizations. This highlights the importance of putting risk concerns in the context of the business and its strategies, given there is not a one-size-fits-all list of risk concerns.

Additional Resources

In addition to the full report, 2023 & 2032 Executive Perspectives on Top Risks report from Protiviti and NC State University, you may also download an Executive Summary and Infographic at the links below. A podcast highlighting the key results is also provided below.

Register for the Webinar

January 11, 2023 @ 12 PM EST

1.2 CPE Hours

Protiviti has once again partnered with NC State University’s Enterprise Risk Management (ERM) Initiative to conduct our annual survey on Executive Perspectives on Top Risks. Our report illuminates the views of board members and C-suite executives about risks that are likely to affect their organizations in 2023, as well as over the next 10 years.

Please join us for a discussion of the top risks identified in our survey, including people- and culture-related concerns as organizations face a disruptive decade requiring agility and resilience to succeed.

Learning objectives:

- Understand the overall survey results and key findings

- Identify the top 10 risks for 2023 and 2032

- Discuss the implications for organizations and how to respond to these top risks

CPE: 1.2 credits available for live attendance

*CPE for qualifying live attendees only. You must answer 3 of the 4 poll questions during the live event. CPE will be e-mailed to qualifying attendees within 60 days of the live event by Protiviti.

Field of Study: Auditing

Program Level: Basic

Delivery Method: Group Internet-Based.

Prerequisites/Advance Preparation: None.

Elements of Engagement: Polling Questions

Original Article Source: “2023 & 2032 Executive Perspectives on Top Risks”, Mark S. Beasley and Bruce C. Branson, Protiviti, 2023

Partnership Between

- Categories:

- Types: