- This event has passed.

Spring 2024 ERM Roundtable Summit

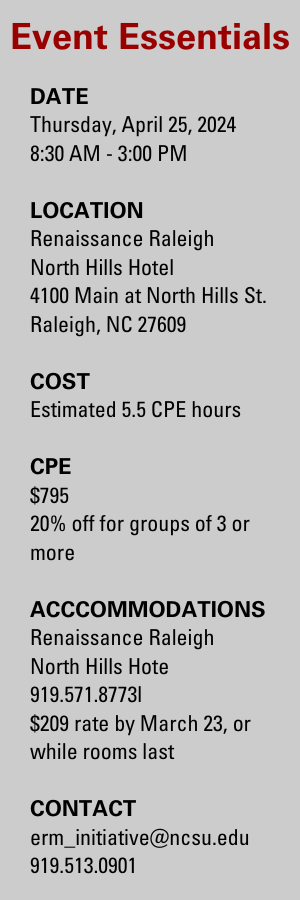

April 25, 2024 @ 8:30 am – 3:00 pm

The ERM Roundtable Summit brings together every Fall and Spring leading risk management professionals to cultivate thought leadership around emergent ERM issues.

Thursday, April 25, 2024 | 8:30 AM – 3:00 PM, with check-in and breakfast beginning at 7:30 am

5.5 estimated CPE Hours

Cost: $795 per person – includes all program materials, breakfast and lunch (cancellation policy)

SPEAKERS AND TOPICS

The Summit will feature a number of speakers who will share about their organization’s ERM practices, highlighting what is working well and opportunities for improvement.

Here are our confirmed speakers. Check back soon for our announcements of additional speakers.

Strengthening Organizational Resiliency to Deflect Fraud-Related Risks

Bill Fox

Senior Risk Advisor for Financial Crimes

Bank of America

Charlotte, NC

Unfortunately, in today’s global business environment “bad actors” exist who may infiltrate an organization’s business through unethical, fraudulent, or sanctioned activities. Organizations can face significant reputational harm and regulatory or legal ramifications if they fail to consider and mitigate the complex web of fraud exposures. In this session, Bill will share insights from his experiences from leading Bank of America’s global financial crimes risk program that is focused on the mitigation of compliance and operational risks associated with the implementation of laws and regulations related to anti-money laundering, fraud, and economic sanctions. He will provide a look into the realities of the hard-to-detect fraudulent activities that may impact an organization, and he will highlight the challenges of ensuring compliance with emerging regulations to prevent those activities, such as sanctions imposed in response to the Russian invasion of Ukraine.

Enhancing Organizational Resilience with ERM

Coral Gottlieb

Director, Business Resilience and Safety

Levi Strauss & Co.

San Francisco, CA

Uncertainties abound in the global business environment often triggering unexpected risk events that threaten an organization’s operations and achievement of its strategic objectives. In light of that reality, strengthening an organization’s resiliency makes good business sense as it enhances the organization’s agility when navigating sudden shocks. In this session, Coral will provide an overview of how the focus on enhancing organizational resiliency helps frame the work of ERM at Levi Strauss. She will share insights about the work they are doing to strengthen the company’s nimbleness in dealing with unexpected events that may be on the horizon and provide perspectives as to how that strengthens the value of an organization’s ERM efforts.

Enhancing Board Communications about Risks

Yogi Verma

Senior Vice President – Enterprise Risk Management

PRA Group, Inc.

Norfolk, VA

Communicating information about risks to an organization’s board of directors can be challenging as management tries to balance providing sufficient details about risks while at the same time helping highlight overarching insights about how those risks might be interrelated and how they impact the organization’s strategic objectives. Management teams sometimes struggle finding the right methods that are most effective in communicating complex risk issues to the board to support its risk governance. Yogi will share insights about how management at PRA Group is leveraging the benefits of visualization tools to help share key risk insights with their board and other key stakeholders. He will also highlight challenges and opportunities for risk leaders to simplify and amplify their impact.

Navigating the Complex Web of Geopolitical Risks

Mike Pfister

Head of Development Center

International Committee of the Red Cross (ICRC) Geneva, Switzerland

Established in 1863, the ICRC operates worldwide, helping people affected by conflict and armed violence and promoting the laws that protect victims of war. An independent and neutral organization, its mandate stems essentially from the Geneva Conventions of 1949. It is based in Geneva, Switzerland, and employs over 21,000 people in more than 100 countries. The ICRC is funded mainly by voluntary donations from governments and from National Red Cross and Red Crescent Societies. International Committee of the Red Cross (icrc.org). The ICRC responds to humanitarian crises across the globe, in situations involving extreme risk. Given the nature of the work they do, the ICRC must navigate the very complex challenges of assessing and responding to dynamically changing geopolitical risks. Mike will share insights about how the ICRC partners with development actors, including international financial institutions, to work in some of the riskiest parts of the world and how they must navigate different emerging geopolitical risks to be able to deliver impact for the most vulnerable.

Benefits of Integrating ERM and Sustainability

Chris Turpin

ERM & Insurance Manager

British American Tobacco (BAT) Company

London, England

Growing expectations related to environmental, social, and governance (ESG) priorities are generating increased opportunities and challenges for organizations as they navigate emerging regulations and market pressures. Many organizations are expanding their sustainability efforts to address an evolving ESG landscape. Many are realizing the benefits of integrating enterprise risk management (ERM) and ESG efforts to provide a more holistic view of how ESG risks and opportunities interact with other risks facing the business. In this session, Chris will share insights about BAT’s ERM program and how it supports the organization’s sustainability agenda, and he will share perspectives on how the company is tracking a number of climate diagnostics to analyze climate-related risks.

REFUND/CANCELLATION POLICY

Download the Cancellation Policy to read our policy on refunds and cancellations.

Important Cancellation Information:

- If written cancellation requests are received by 5:00 PM Eastern time, twenty-one (21) days PRECEDING the date of the event, the registration fee will be refunded less a $50 processing fee.

- Due to financial obligations incurred by the ERM Initiative, a credit voucher equal to 50% of the registration fee will be issued for written requests received by 5:00 PM Eastern time, seven (7) days PRECEDING the date of the event. Credit vouchers can be applied towards future ERM Initiative events within 12 months of the cancellation.

- A FULL refund shall only be given for an event that is cancelled by the Initiative for any reason (speaker issues/conflicts, unexpected low attendance #s, etc.). NOTE: All other costs (exchange rate fees, airfare, etc.) incurred by the registrant for the event are the responsibility of the registrant with no additional refunds from the ERM Initiative.

- No refunds or credits will be issued for written cancellation requests received after 5:00 PM Eastern time seven (7) days PRECEDING the date of the event.

CPE INFO / FORMAT

| Level: | Basic |

| Prerequisites & Advanced Preparation: | None |

| Field of Study: | Management Services: Enterprise Risk Management |

| Format: | Group-Live |

| Learning Objectives: | Click HERE |

| Recommended CPE: | Estimated 5.5 |

| Cost: | $795 |

The NC State University Executive Education, LLC is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: http://www.nasbaregistry.org.